The AI-Powered unified testing platform

Plan, execute, analyse and report all testing activities in a single workspace

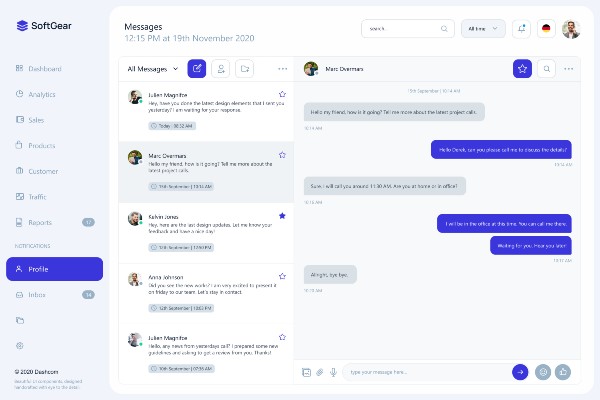

- Quick Connect

- Clean Interface

- Advance Analytics

- Our CLients

- Highly recognised by qa community

- Products

Testing Cloud & Infrastructure

A combination of testing platform and execution environment designed to accelerate QA process

Design

- Outline quality standards and expectations. - Generate test suites and test cases while ensuring full traceability to requirements. - Streamline documentation organization and accessibility with ease

Execute

- Plan your testing phase, creating test runs and defining testing configurations. - Execute tests against scalable managed infrastructure allowing you to emulate user environments and test on real devices.

Analyse and Report

- Identify defects and issues early in the development cycle, reducing the cost and time required to fix them.

- Monitor the software quality, reporting on key metrics and identifying areas for improvement.

- Set & Forget

Zebrunner Testing Platform

A unified hub for manual and automated testing includes

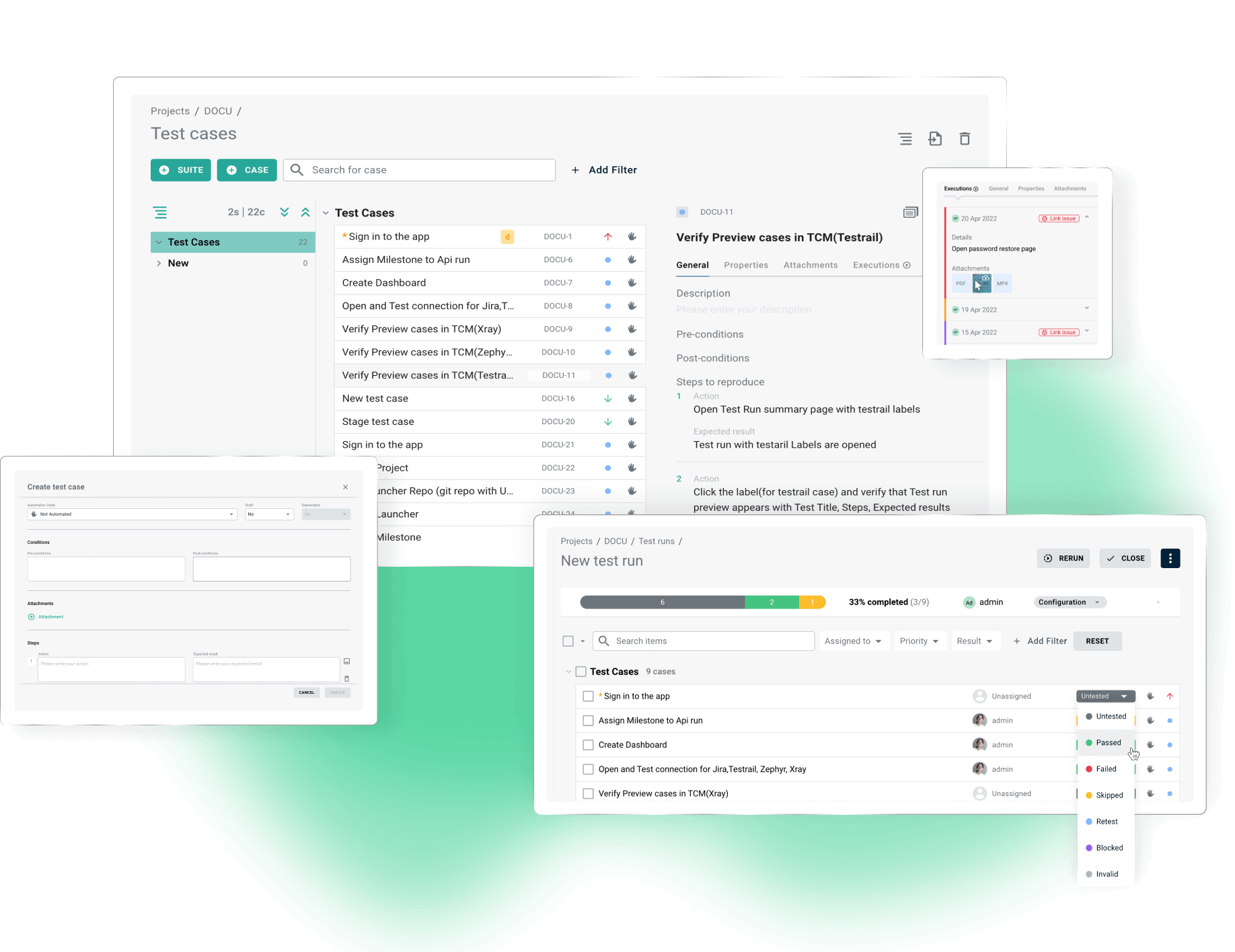

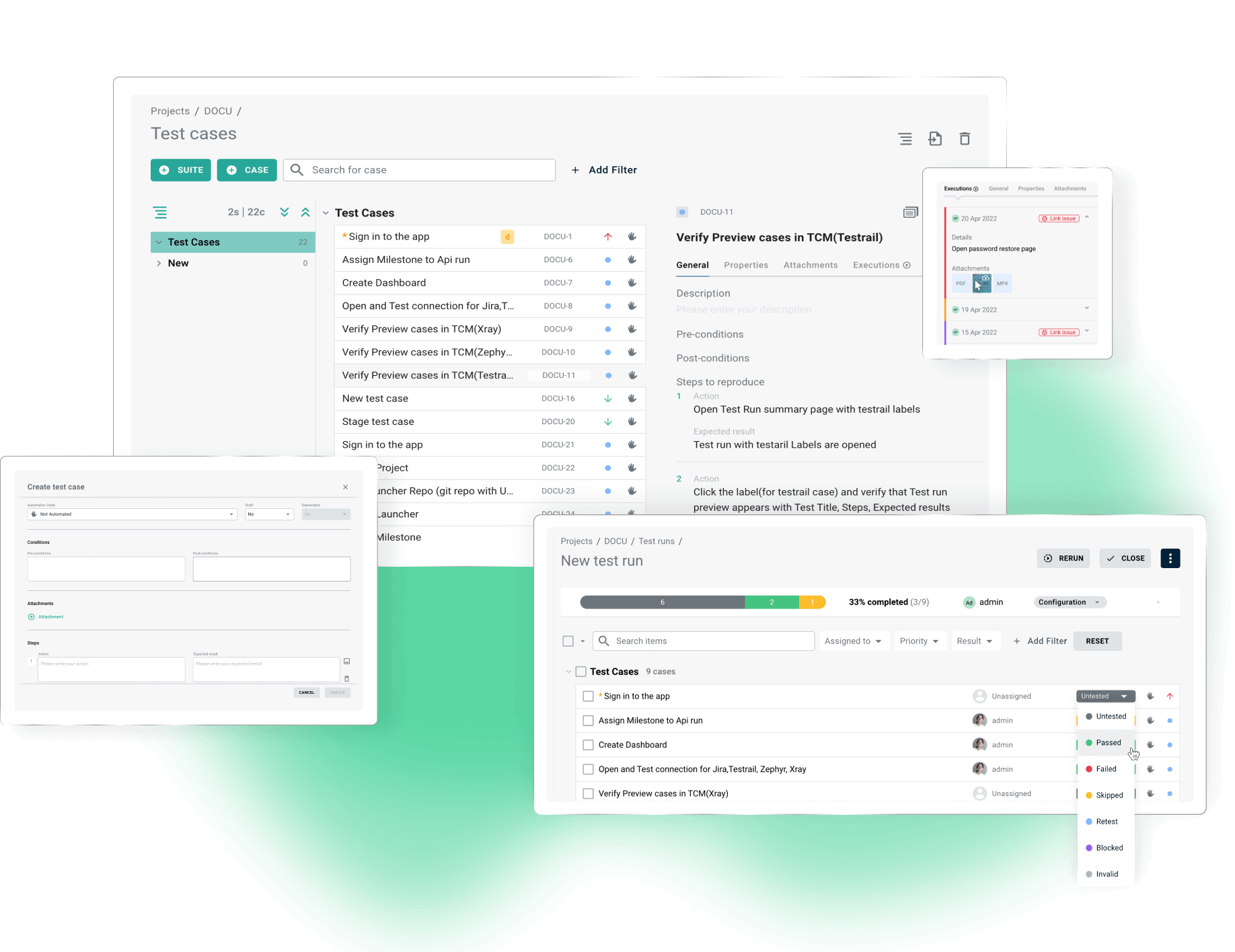

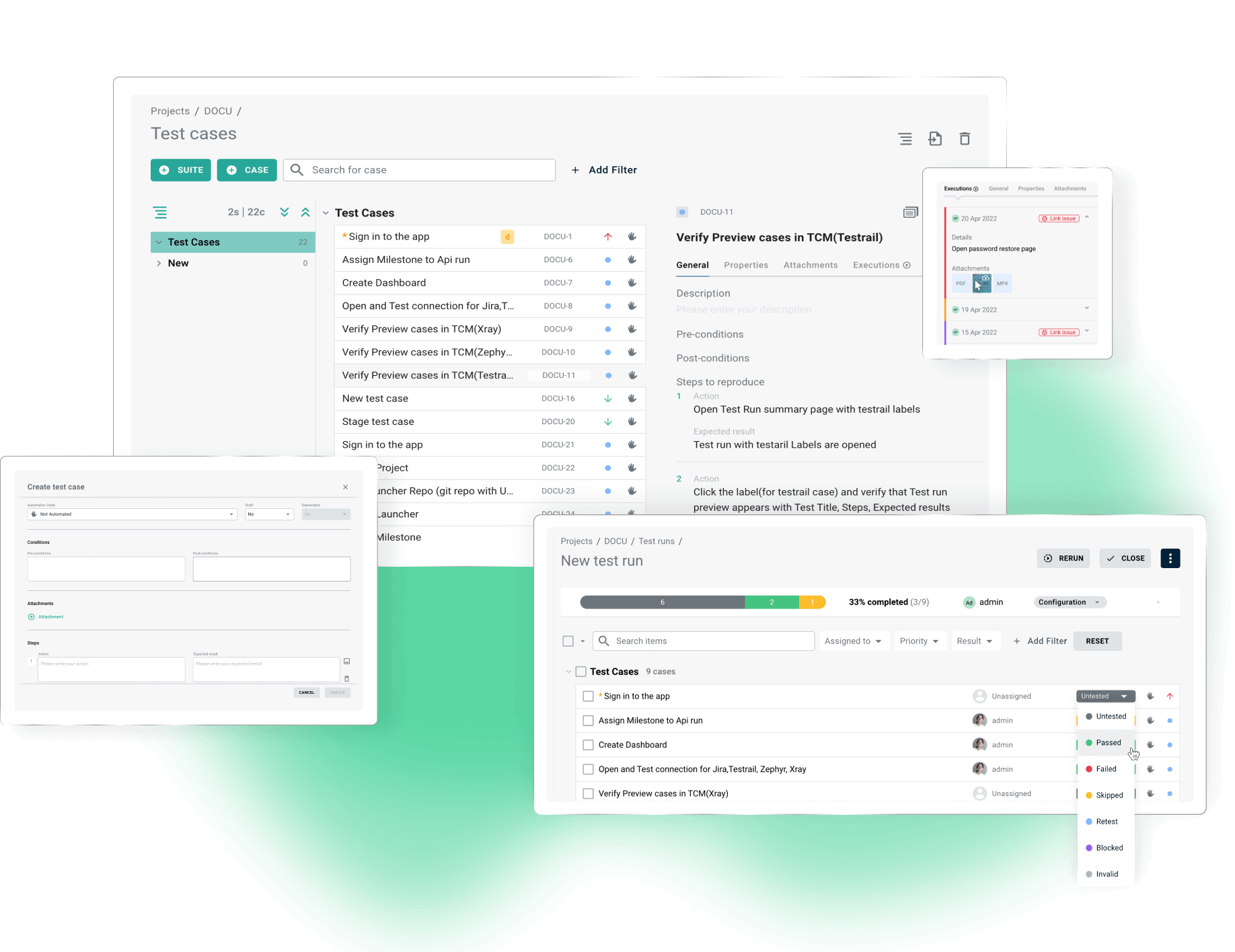

Test Case Management

Test documentation management and planning

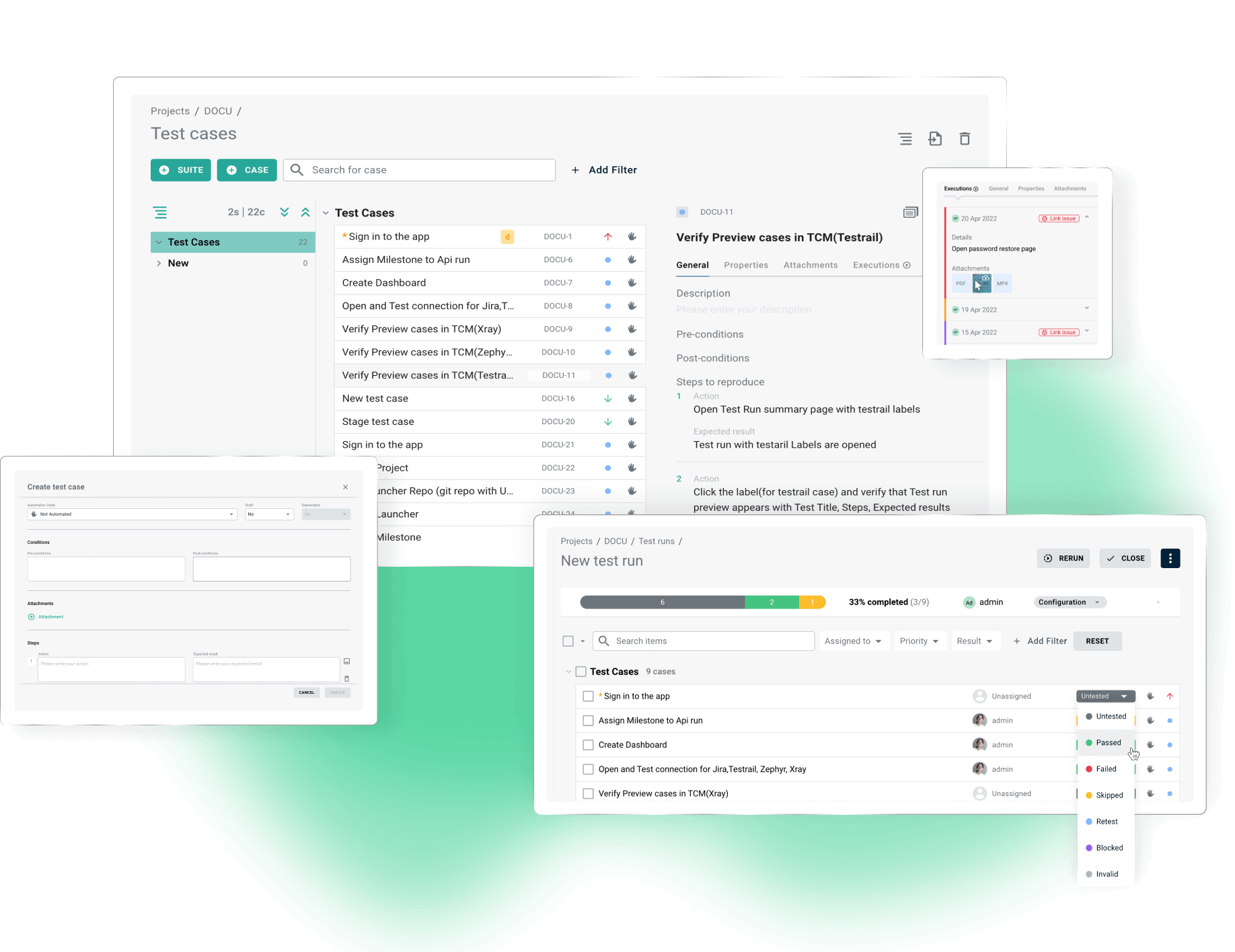

Testing Platform

Collaborative environment for manual and automated testing

Zebrunner Selenium Grid

Cross-browser web applications testing

Device Farm

Automated and manual testing on real devices

Zebrunner CyServer

Multithreaded cross-browser web application testing with Cypress

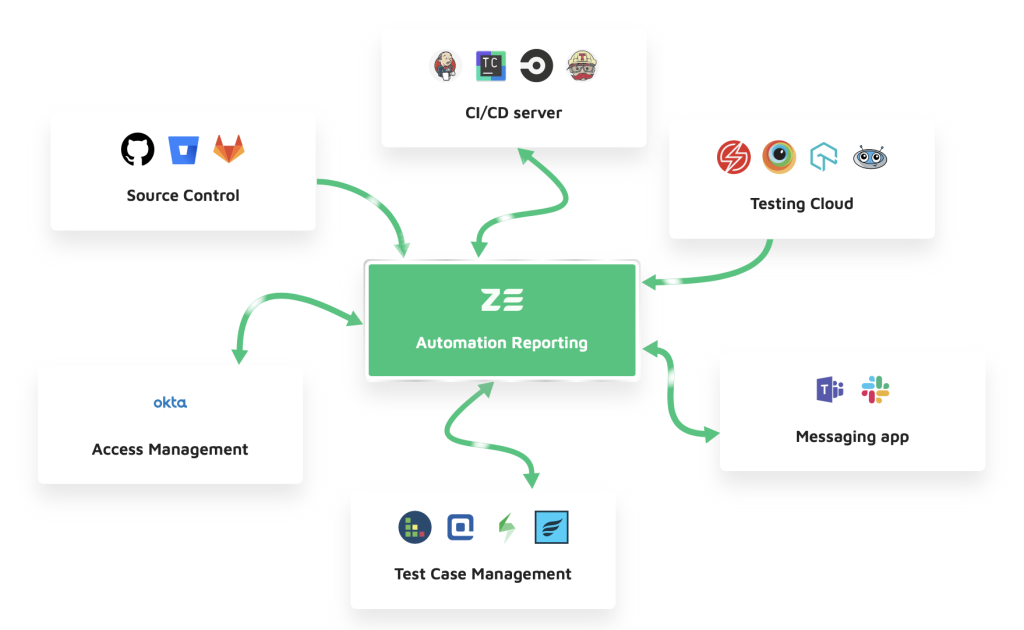

Automation Reporting

Reporting and analytics for automated testing

- Integration

Solutions

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Create & format test cases as you prefer via rich-text editor

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip.

- Zebrunner For Manual QA Teams

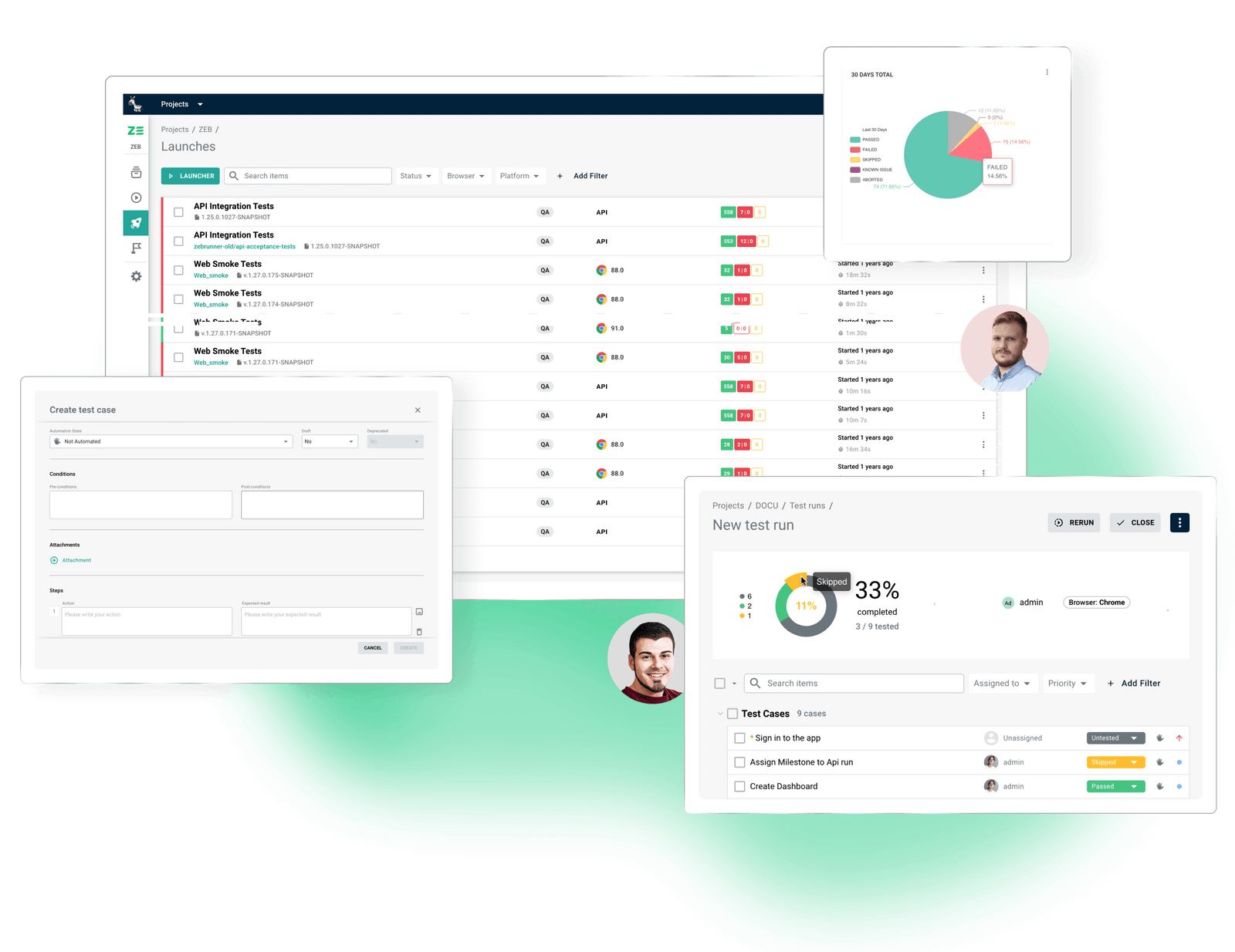

Streamlined Test Case Management

Create and manage test cases, perform test runs and track the results via an intuitive user interface. Link issues directly to test executions for reaching traceability and visibility of the testing process.

- Simple Test Creation and Organization

- Customizable layout that meets your needs

- Easy test runs and execution management

- Zebrunner For Automation Teams

Scalable Testing Environment

Plan, execute, analyze and report all testing activities in a single workspace

- Run Web, APIs, Mobile tests in parallel with no thread limit

- Test the most recent browsers & platforms on real devices, simulators or emulators

- Identify the root causes faster with AI/ML

- Analyze failures with detailed test results: logs, screenshots, interactive videos

Join 10,000+ testers, developers and QA managers already fixing bugs 2 times faster with Zebrunner

- Products

Featured Products

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

For manual QA teams

Create & format test cases as you prefer via rich-text editor Save time organizing test cases & test suites with drag-n-drop feature Perform test runs and assign them to different users in a click with bulk actions Receive real-time insights via various activity charts

For automation teams

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis

360 Degree View QA

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis

- 360 degree view QA

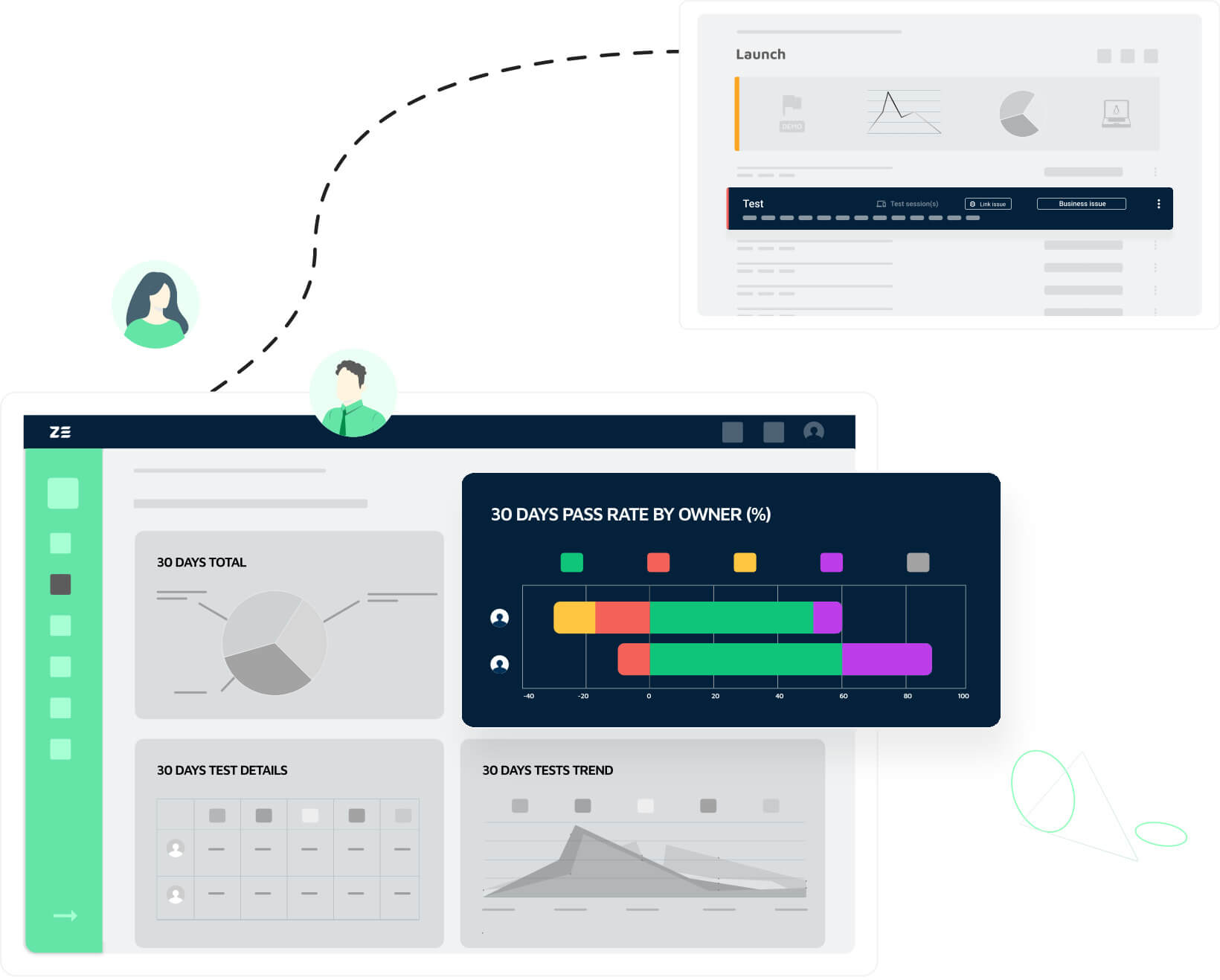

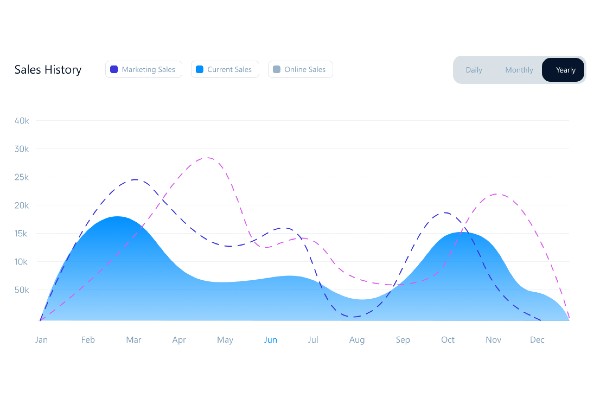

Automation Reporting

Make your test automation process easier than ever and take debugging to the next level.

- Connect existing test automation project

- Perform comprehensive test failure analysis

- Track QA progress with live customizable reports

- Check the health of automation with real-time analytics

- Workflow

Zebrunner For Manual QA Teams

- Save time organizing test cases & test suites with drag-n-drop feature

- Perform comprehensive test failure analysis

- Track QA progress with live customizable reports

01

Register Account

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis

02

Automatic Sync

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis

03

Connect Database

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis

- Features

Zebrunner Integrations

Easily integrate Zebrunner with your favorite tools for test automation, test management, team communication, and more. Check the list!

Jira

Create bugs in Jira dashboard from Zebrunner test session or test run.

GitHub

Zebrunner-GitHub integration will help you manage bugs in GitHub while performing testing.

GitLab

Zebrunner-GitLab Integration allows you to create a card directly in your repo from Zebrunner.

Slack

Boost testing productivity: efficiently manage test cases, plans and runs right from Zebrunner grid.

- Reviews

Reviews

Check more reviews on Capterra or G2

- Support

Why Companies Switch To Zebrunner

Modular and Embeddable Design

Our products are built in a way that allows you to seamlessly integrate them into your SDLC and with the tools you already use. If needed, they can also be combined to create a complete quality assurance ecosystem

AI/ML-powered failure classification

Find out failure reasons automatically with AI/ML based on stack traces. Train the system by accepting or rejecting the classification and increase the accuracy to up to 100%.

Simple migration

Simple migration from any other tool

- Pricing

Simple pricing plan

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

- no credit card required

Try advanced features for 14 days

Make your test automation process easier than ever and take debugging to the next level.

- Shared space with all test results, tools & integrations

- End-to-end traceability throughout the testing life cycle

- Project performance monitoring and real-time analytics

- Live dashboards & visual charts reporting

- Milestones for effective release planning & progress tracking